harrisburg pa local services tax

PSD Codes political subdivision codes are six-digit. The tax which is deducted from the paychecks of people who work in the city is being tripled from 52 per year to 156 per year.

Harrisburg Pennsylvania Pa Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

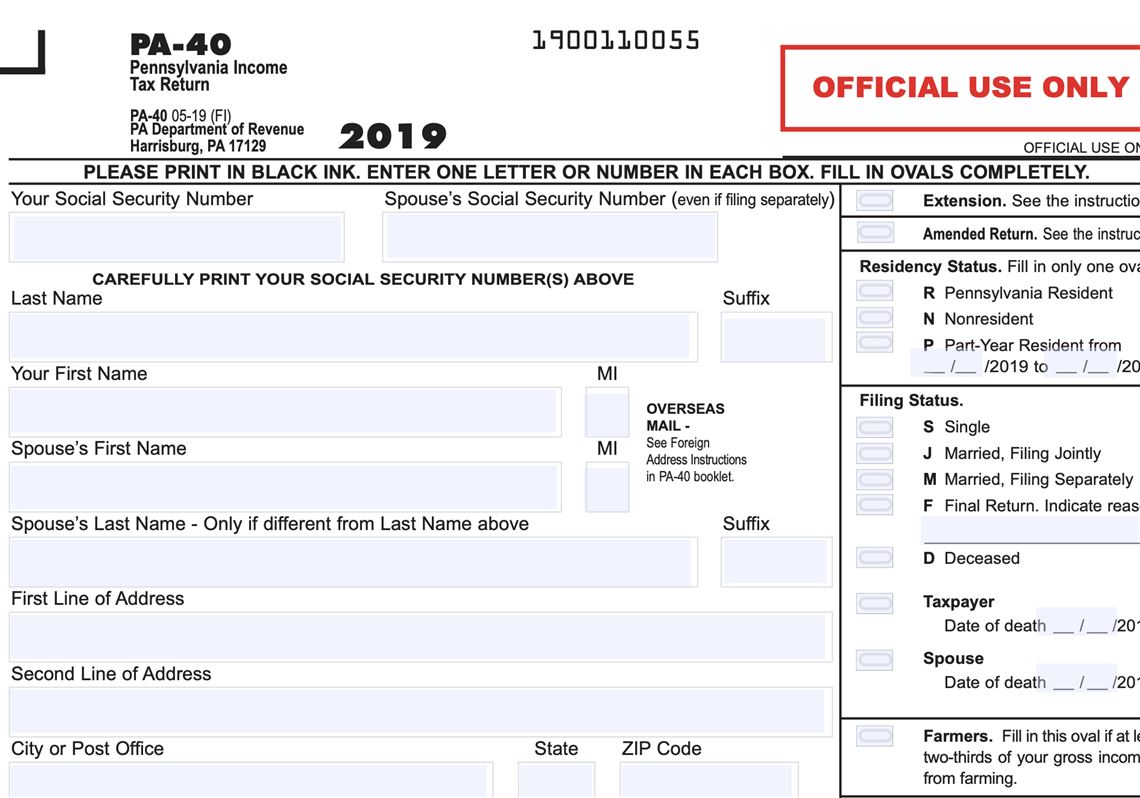

Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and Local.

. See reviews photos directions phone numbers and more for the best Tax Return Preparation in Harrisburg PA. The out-of-state resident employee will still be subject to and. Capital Tax Collection Bureau Perry County Office Moving.

2 South Second Street. Each payment is processed immediately and. For an employee who lives out-of-state the Resident PSD Code will be 880000 and the Total Resident EIT Rate will be 0.

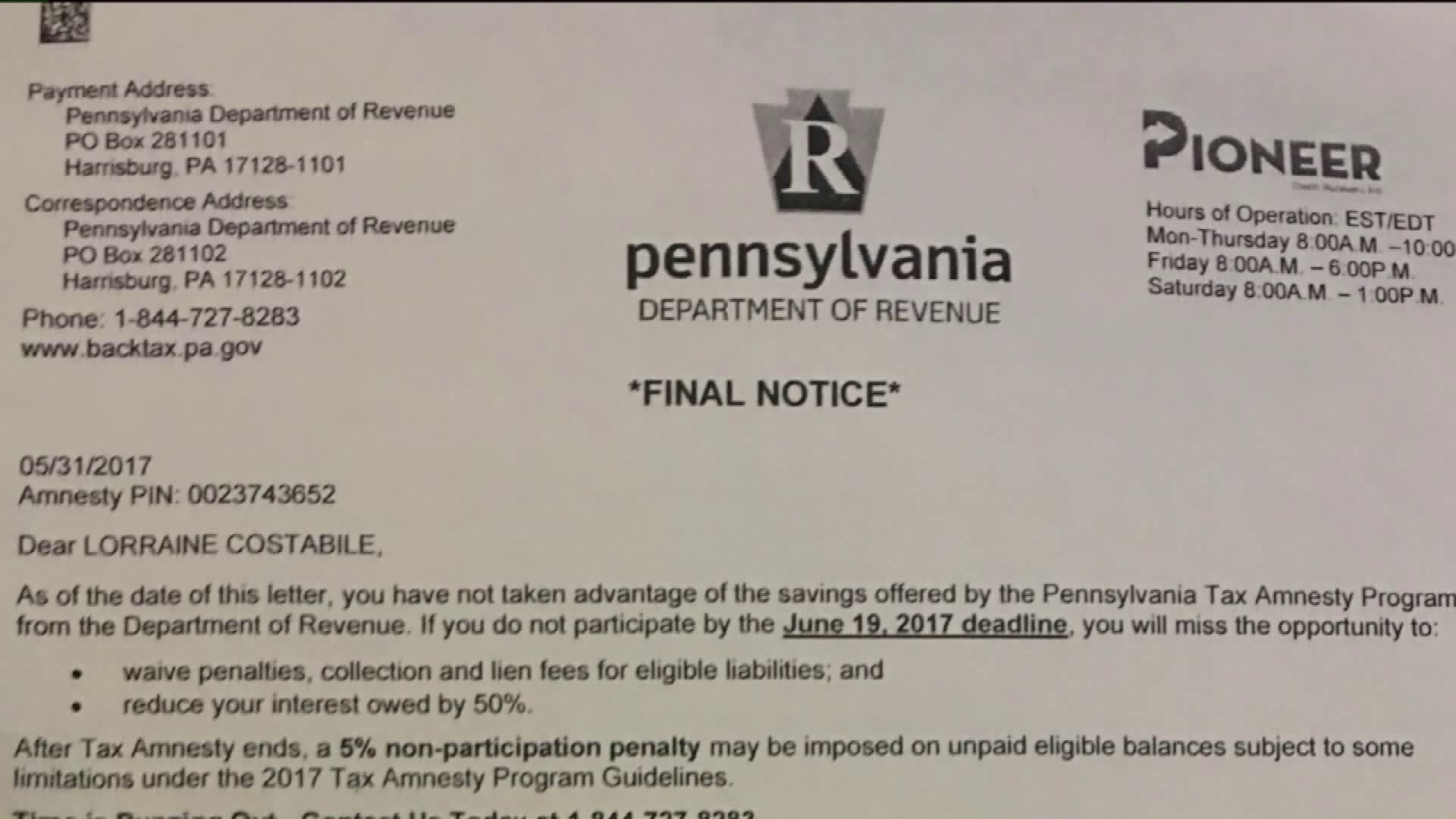

Harrisburg is authorized to set the Local Services Tax rate at 156 per year under the state Financially Distressed Municipalities Act also known as Act 47. Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and Local Services Tax LST on behalf of their employees working in. Capital Tax Collection Bureau Closing Somerset Office.

Online Payment Service by VPS. Local Services Tax LST Act 7 of 2007 amends the Local Tax Enabling Act Act 511 of 1965 to make the following major changes to the Emergency and Municipal Service. Pennsylvania Department of Community Economic Development Governors Center for Local Government Services 400 North Street 4th Floor Harrisburg PA 17120-0235 Phone.

Monday - Friday from 800 AM to 430 PM. This service provided by Value Payment Systems allows you to pay your City of Harrisburg PA payments online. Tax Return Preparation Financial Services Tax Reporting Service Tax Return Preparation-Business Taxes-Consultants Representatives 2725 Agate St Harrisburg PA 17110 Tel.

Making tax collection efficient and easy for over 35 years. The increase only applies to people who make. The local tax filing deadline is April 18 2022 matching the federal and state filing dates.

Our mission is to improve the quality of life for Pennsylvania citizens while assuring transparency and accountability in the expenditure of public funds. Local Income Tax Requirements for Employers. The Local Services Tax LST for cities in Pennsylvania is withheld on a mandatory basis from the salaries of employees whose duty stations are located in the cities listed below.

We offer user-friendly online services coupled. Harrisburg is authorized to set the Local Services Tax rate at 156 per year under the state Financially Distressed Municipalities Act also known as Act 47. Harrisburg PA Pennsylvania collected 24 billion in General Fund revenue in February which was 1557 million or 68 percent more than anticipa.

Hershey Creamery Company Linkedin

Harrisburg Pa Files For Bankruptcy Politico

Pin By Utahmutah On 1 Ultra Violet Pharmaceutical Manufacturing Ultraviolet Radiation

Raise Business Taxes Pittsburgh Post Gazette

Who S Running For Office Harrisburg Pa Home Facebook

Municipal Folly Bankrupts A State Capital Cbs News

Harrisburg Council Passes 2022 Budget Wanda Williams First As Mayor Pennlive Com

Harrisburg Needs Donations From Tax Exempt Properties Pennlive Com

Who S Running For Office Harrisburg Pa Home Facebook

What You Need To Know About The 2022 Pa Governor S Race Whyy

American History Tv In Harrisburg Pennsylvania C Span Org

Delay Of Tax Deadline Due To Covid 19 Will Cause Significant Disruption To Pa S Budget Process Pittsburgh Post Gazette

What S Behind Gop Gov Candidates Demand To Keep Debates Insular Whyy